.png)

Company mergers and divisions: When are they worthwhile and how can they be managed without damage

In the dynamic world of business, continuous development is key to maintaining competitiveness and long-term success. For many companies, mergers and divisions are not only a path to expansion, optimization, or rescue, but also a strategic tool for redefining their market position. These complex processes, while promising significant benefits, are also fraught with legal, financial, and operational pitfalls.

Author of the article: ARROWS (JUDr. Jakub Dohnal, Ph.D., LL.M., office@arws.cz, +420 245 007 740)

.jpg)

Why are mergers and acquisitions crucial for your business?

Mergers and acquisitions (M&A) are common tools for organizational concentration and strategic management of companies worldwide. Why should you be interested in them? The primary goal of these transactions is often to achieve maximum profit, accelerate company growth, and gain a larger market share. They represent an effective way to expand and strengthen your competitive position. On the other hand, company divisions offer the opportunity for effective restructuring, separation of unprofitable parts of the business, or the creation of holding structures for better and clearer management.

These transformations are not mere administrative acts, but strategic responses to economic, strategic, and legislative pressures. They enable companies to respond flexibly to a changing business environment, adapt to new challenges, and take advantage of emerging opportunities. In today's world of constantly evolving markets and intensifying competition, the ability to transform a business effectively is critical to its long-term prosperity.

Business transformations as a tool for future success

A properly executed transaction, whether a merger or a spin-off, can deliver significant synergies and economies of scale that would otherwise be unattainable. It can also open the door to technological innovation, new distribution channels, and access to talented teams that will strengthen your company's overall capacity.

The key to the success of these complex processes is a precise strategy and thorough preparation that minimizes risks and maximizes potential benefits. Without clearly defined goals and a well-thought-out plan, even the most promising transformations can fail.

It is essential to understand that companies that view mergers and acquisitions as proactive strategic tools for building competitive advantage and long-term stability, rather than merely reactive solutions to crisis situations, achieve significantly better results. While some companies only take these steps when they are facing financial problems or need to address urgent operational issues, forward-thinking management integrates them into their long-term vision.

This requires a deep understanding of the market, internal capacities, and future opportunities, with legal support essential from the very beginning of strategic planning. A proactive approach will not only allow you to avoid potential pitfalls, but also to fully leverage the transformative potential of these operations.

Company mergers: Joining forces for new opportunities

Mergers are one of the most powerful tools for business transformation, allowing two or more companies to join forces. Although complex and legally demanding, this process opens the door to new markets, technologies, and significant competitive gains.

What is a merger and what forms does it take?

A merger is a legal process of transforming legal entities, resulting in their combination. It is important that all companies involved in the merger have the same legal form (e.g., LLC, corporation, or cooperative).

There are two main types of mergers, which differ in their impact on the existence of the original companies:

- Merger by consolidation: One or more companies cease to exist without liquidation and all their assets are transferred to one existing successor company. An example is the merger of transport companies DPD and Geis in the Czech Republic.

- Merger by amalgamation: Two or more participating companies cease to exist without liquidation and their assets are transferred to a newly formed successor company. This is often referred to as a "merger of equals." An example is the creation of the car manufacturer Stellantis (merger of Groupe PSA and Fiat Chrysler Automobiles).

Mergers can be further categorized according to the relationships between the merging companies:

- Horizontal integration: Merges companies in the same industry and stage, often direct competitors. The goal is to increase market share and achieve economies of scale.

- Vertical integration: Merges companies in different, related stages of the production process. The goal is to gain control over the entire business and reduce dependence on external suppliers. An example is a flour manufacturer that buys a bakery.

- Congeneric integration: Connects companies from related business areas (e.g., a bank and an insurance company).

- Conglomerate integration: Brings together companies without mutual ties to diversify their portfolio and expand into new areas. An example is the acquisition of PayPal by eBay.

When is a merger worthwhile? Strategic motives and benefits

The decision to merge is always strategic. Key motives include:

- Accelerated growth and expansion into new markets: A merger is a faster way to access new customer bases and distribution networks.

- Gaining access to new technologies and know-how: It is more advantageous to buy a competing company with valuable patents than to engage in lengthy internal development.

- Cost optimization and synergies from scale: A merger allows for shared administrative costs, a better negotiating position with suppliers, and more efficient use of capacity. However, more than 60% of business combinations fail due to unrealistic expectations of synergies, leading to unfulfilled expectations and high integration costs (e.g., the merger of Daimler and Chrysler).

- Strengthening market position and eliminating competition: The newly formed company gains a larger market share, enabling it to compete more effectively.

- Risk diversification and rescue of financially weaker companies: Merging with another, more stable company can save financially weaker companies from bankruptcy.

- Tax advantages: Utilization of one company's tax losses by another. Warning: Tax optimization must not be the only reason. Tax authorities carefully examine the purpose of transactions; if the primary goal is only tax savings without a robust business justification, there is a risk of additional assessments or penalties.

Company division: Effective restructuring and focus on core business

While mergers bring companies together, divisions offer a way to split up a company in order to increase efficiency, manage risk, or optimize structure. The process is regulated in detail in Act No. 125/2008 Coll., on the transformation of commercial companies and cooperatives (hereinafter referred to as the "Transformation Act").

What is a division and what forms does it take?

There are two main traditional types of division:

- Split: The original legal entity ceases to exist and its assets are divided among newly formed or existing successor companies.

- Division by spin-off: The original company does not cease to exist, but part of its assets are separated and transferred to another (existing or newly established) company. This is often used to spin off a specific division without jeopardizing the main business.

New provision in the Act on Transformation of Commercial Companies and Cooperatives (Amendment No. 162/2024 Coll.)

On June 19, 2024, the long-awaited amendment to the Act on Transformation of Commercial Companies and Cooperatives was promulgated, effective as of July 19, 2024. It introduces a fundamental change in the form of a new type of division: spin-off.

Spin-off is a process whereby the divided company does not cease to exist, but only spins off part of its assets, which it transfers to another company in exchange for a share. The amendment characterizes two forms of spin-off:

- Spin-off with the establishment of a new company (new companies): The divided company, without ceasing to exist, transfers part of its assets to a newly established company (companies) that will be wholly controlled by the divided company (similar to the establishment of a subsidiary).

- Spin-off by merger: Part of the assets of the company being split is transferred to an existing company, with the company being split acquiring a share in that company. This method opens up new possibilities for structuring acquisitions or joint ventures.

It is important to note that spin-offs can only be used for commercial companies, not cooperatives. The amendment also simplifies the process of appointing an expert to value non-monetary contributions.

When is a division worthwhile? Strategic reasons and advantages

A company division is a strategic step that can bring a number of significant advantages:

- Optimization of ownership structure and tax optimization: More efficient asset management and tax savings by separating business activities into separate entities.

- Risk management and spin-off of unprofitable parts: Protection of core business from risks associated with less profitable divisions.

- Streamlining management and creating holding structures: Creation of separate entities with their own managers and strategies to increase agility and efficiency.

- Change of legal form and separation of activities: E.g., transition from sole proprietorship to limited liability company for limited liability and greater credibility.

- Realistic accounting presentation of the company: Revaluation of assets to fair value for a more accurate and up-to-date view of assets.

- Minimization of interrelationships: Reduction of mutual liability between the original and spun-off companies to simplify future operations.

The choice of legal form has a fundamental impact on a company's strategic options. ARROWS lawyers will help you analyze which legal form is best suited to your future strategy.

How to manage a merger or division without damage: Key legal steps and pitfalls

Successful mergers and divisions are not the result of chance, but of careful planning, thorough review, and precise compliance with legal regulations. Underestimating any of these aspects can lead to serious financial, legal, and reputational damage, threatening the very existence of the company.

Comprehensive preparation: The foundation for success

Every corporate transformation begins at the drawing board, long before the first documents are signed. Comprehensive preparation is key:

- Strategic planning and goal definition: Clearly define the goals of the merger or division, whether it is growth, synergy, entry into new markets, or structural optimization.

- Due diligence: A critical step involving financial, legal, and operational audits. The aim is to identify potential problems such as hidden debts, litigation, regulatory risks, or cultural incompatibilities. ARROWS lawyers uncover hidden legal risks during due diligence and help minimize them, thereby protecting your interests.

- Negotiation and transaction proposal: Based on the results of the due diligence, the key terms of the transaction are agreed upon and a draft contract or division plan is prepared.

Legal aspects and documentation: What you need to know

The entire process of company transformation in the Czech Republic is governed by strict rules of Czech law, in particular Act No. 125/2008 Coll., on the transformation of commercial companies and cooperatives, as amended, including the recent amendment No. 162/2024 Coll.

- Transformation project and its requirements: This written document is the cornerstone of the entire process and must be filed with the Commercial Register at least one month before the date on which the transformation is to be approved. The project contains identification details, the effective date of the merger, proposed amendments to contracts, and other key information.

- Financial statements and expert opinions: Before a merger or division can take place, final financial statements and an opening balance sheet must be prepared. In some cases, an expert opinion is required to value the assets.

- Approval of the transformation and entry in the commercial register: The transformation must be approved internally by the relevant bodies of the companies. The legal effects of the merger take effect on the date of entry of the transformation in the commercial register.

- Protection of creditors and shareholders: The law places great emphasis on protecting the rights of creditors and shareholders. Creditors may assert their claims in court no later than three months after the date of publication of the transformation plan. Shareholders are entitled to compensation, exchange of shares, damages, or repurchase of shares.

Regulatory oversight and protection of competition

Every significant corporate transformation is subject to oversight by regulatory authorities, in particular the Office for the Protection of Competition (ÚOHS). The ÚOHS monitors business combinations to prevent the creation of monopolies or the distortion of competition.

Companies must ensure compliance with legislation such as Act No. 143/2001 Coll., on the Protection of Economic Competition, and avoid prohibited agreements (e.g., price cartels). Violations of these rules lead to heavy fines, which can reach up to 15% of the competitor's total annual turnover.

Risks and how to avoid them: From financial to cultural

Despite the potential benefits, mergers and divisions are associated with a number of risks:

Financial risks

- Overpayment and overvaluation of future profits: A common risk where expected synergies are not realized.

- Debt burden: High financial investments can threaten stability.

- Cash trap: Revaluing assets at fair value can lead to the creation of goodwill, which reduces reported profits and limits the possibility of paying out profit shares, even if equity increases on the balance sheet. The solution is to plan the accounting impacts in advance.

Cultural and human risks

- Cultural incompatibility and communication barriers: The greatest risk is failure to harmonize different corporate cultures, leading to productivity and morale problems.

- Employee patriotism and demotivation: Employees may feel detached from their original brand. It is therefore very important to communicate the merger correctly and emphasize the benefits for individual employees.

Regulatory and legal risks

- Risk of monopolization: May lead to the transaction being blocked by antitrust authorities.

- Non-compliance with legal regulations: Incorrect implementation of the integration or non-compliance with legislation may lead to legal disputes, invalidity of the transformation, additional tax assessments, and penalties.

- Integration problems after the transformation: Technological, operational, and organizational integration requires transparent communication and flexibility, otherwise delays will occur.

Given the scope and severity of the potential risks—ranging from financial losses to the invalidity of the transaction to personal criminal liability of statutory bodies—legal preparation and compliance cannot be viewed as a mere "administrative burden," but as a critical investment in the stability and future of the company.

Contact our experts:

Liability of statutory bodies: What are the risks and how to protect yourself

Statutory bodies play a key role in the management of a company, and this position comes with considerable responsibility.

Types of liability:

- Civil liability: For damage caused to the company by a breach of the duty of care.

- Criminal liability: In the event of a serious breach of duties (e.g., embezzlement, fraud, misrepresentation of accounts), which can lead to heavy fines and imprisonment.

The duty of care and loyalty is the basis for the protection of statutory bodies. It includes thoroughly checking information, weighing risks and benefits, and acting with the necessary knowledge. To protect yourself, it's key to have enough evidence that you acted with due care, including minutes of meetings and expert opinions.

Consequences of incorrect implementation and penalties

Incorrect implementation of a merger or division can have serious consequences:

- Invalidity of the transformation and its effects: Once the transformation has been entered in the commercial register, it can no longer be declared invalid. The transaction becomes legally irreversible. After registration, the shareholders are only entitled to monetary compensation.

- Tax assessments and penalties: If the transformation is not fully compliant with the law, additional tax assessments or penalties may be imposed by the tax authorities (for the purpose of the transaction) or by the Office for the Protection of Competition (for anti-competitive conduct).

- Penalties for violating the Transformation Act: A special financial authority may impose administrative fines for violating the obligation to notify cross-border arrangements.

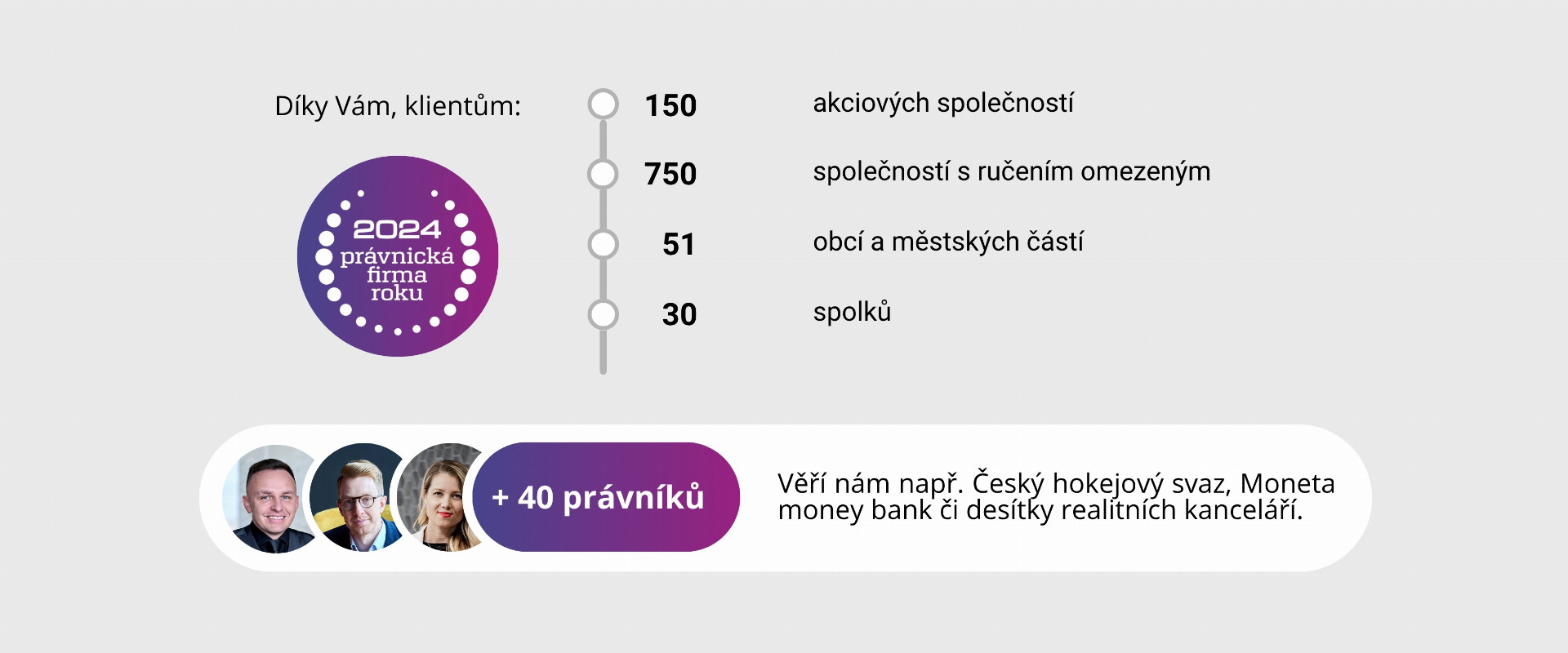

ARROWS: Your reliable partner for corporate transformations

At ARROWS, we understand that mergers and divisions are among the most complex and significant moments in the life of any company. These are not just legal acts, but strategic decisions with far-reaching implications for the future of the company.

How ARROWS lawyers help minimize risks and maximize benefits:

- Comprehensive legal advice: We provide advice from the initial stages of strategic planning to the post-integration phase, ensuring compliance with legislation and support for long-term goals.

- Value-added due diligence: We conduct in-depth reviews to identify all potential pitfalls and assess the real benefits of the merger.

- Precise preparation of documentation: We prepare all necessary documentation with an emphasis on minimizing the risk of transaction invalidity and ensuring legal certainty.

- Navigation through the regulatory environment: We monitor the latest legislative changes and ensure compliance with antitrust laws (ÚOHS) to prevent fines and transaction blockages.

- Protection of statutory bodies: We provide advice on the responsibilities of statutory bodies, assist with compliance with due diligence and minimise civil and criminal risks.

- Resolution of tax and accounting implications: We work with financial experts to ensure optimal tax and accounting solutions and avoid unpleasant additional tax assessments.

- Communication strategy: We advise on transparent communication with all stakeholders—employees, customers, partners—for smooth integration and preservation of corporate culture.

Conclusion: Transformation as an opportunity, not a threat

Mergers and acquisitions are powerful tools that can transform your business, open up new opportunities, and strengthen your market position. However, they are also legally and administratively complex, full of hidden risks and potential pitfalls. As we have shown, missteps can lead to serious financial losses, legal disputes, heavy fines, and even personal liability for management.

Summary of key findings:

- Strategic processes: Mergers and divisions are essential for growth, optimization, and risk management.

- Diversity of forms: There are many types and forms of these transformations, each with different impacts that must be carefully considered.

- The basis for success: Careful preparation, thorough due diligence, and precise compliance with legislation are key.

- Regulatory oversight: The ÚOHS closely monitors compliance with competition rules and is prepared to impose heavy penalties.

- A wide range of risks: From financial and accounting problems (including cash traps) to cultural incompatibility and personal liability of statutory bodies.

- Legislative developments: Legislation is constantly evolving (see the amendment to the Business Organizations Act), which requires up-to-date legal expertise.

The complexity of corporate transformations should not be underestimated. Legal preparation is not just a formality, but essential protection for your business and the personal position of its management. It ensures that the transaction proceeds smoothly, efficiently, and in compliance with all legal regulations, thus minimizing the risk of future problems.

ARROWS lawyers have 15 years of experience in corporate transformations and understand the strategic goals of their clients. They are ready to guide you through the entire process – from initial analysis and strategic planning, through detailed due diligence and preparation of all documentation, to smooth integration and minimization of all risks.

Don't let complexity catch you off guard. Contact ARROWS lawyers today to ensure that your corporate transformation is carried out safely, efficiently, and with maximum benefit for your future prosperity. ARROWS lawyers deal with these issues on a regular basis and are ready to help.

.png)