Investing in buying flats - legal and tax pitfalls

Planning to invest in a home and looking forward to passive income? This article is your essential guide. We reveal the most common legal and tax pitfalls, from hidden defects and risky contracts to HOA debts and tax traps. You'll find out how to avoid mistakes that could cost you millions, and how to make sure your investment really pays off. With us, you'll gain certainty and clarity.

Author of the article: ARROWS (JUDr. Jakub Dohnal, Ph.D., LL.M., office@arws.cz, +420 245 007 740)

%20(1).jpg)

The dream of passive income and the hidden nightmares of property investment

Imagine this: every month your rent lands in your account. Your investment home gradually appreciates in value and you build an estate that will give you financial freedom and a decent retirement. It sounds like a dream come true, which is the main motivation for many Czechs to invest in real estate.

However, this idyllic notion can quickly turn into a nightmare of unexpected expenses, legal disputes and tax dodges. Buying a property is not just about choosing an attractive location and negotiating a good price. It is primarily a complex legal and financial process where a single mistake can mean the loss of hundreds of thousands of crowns and years of worry.

This article is not a scare, but a practical guide on how to avoid these risks. We will guide you through the whole process step by step. We'll show you where the biggest risks lurk and how to spot them before it's too late. Because successful investing is not about luck, it's about careful preparation and expert guidance. At ARROWS, we see stories every day of investors who underestimated their preparation. Our goal is to make sure yours is not one of them. This article is the first step toward your safe investment.

Due Diligence.

Before you commit to anything, you need to know the true state of your future investment. Legal due diligence, known professionally as legal due diligence, is just such a process. Think of it as a detailed health check of the property, revealing all its hidden "diseases" and birth defects. It is not a mere formality, but a detailed legal audit that identifies all liabilities, legal defects, title restrictions and other risks. Early detection of these problems gives you a key advantage: the ability to negotiate better terms, seek remedies, or withdraw from the entire transaction in a timely and safe manner.

Many investors believe they need a lawyer only to review the purchase agreement. This is a fundamental and often the most expensive mistake of the entire investment. The most important time to get legal advice is before signing any document, typically a booking contract. This is the one that can lock you into a disadvantageous position, put you under time and financial pressure and trigger an avalanche of problems that cannot be stopped later. Signing a seemingly innocuous booking form without prior legal scrutiny is the first step on the road to a failed investment because it forces you to move forward despite incomplete information and warning signs that a thorough due diligence would have revealed.

Key areas of legal due diligence

Comprehensive due diligence focuses on several key areas:

- Land registry: it is an essential source of information. The title deed (LV) shows who the actual owner is and, in particular, whether there are any legal defects on the property, such as liens (e.g. from the seller's mortgage), foreclosures or easements. Easements in particular can be fatal for an investor - for example, the right of lifetime use of an apartment for a relative of the seller means that you will not be able to rent the apartment for years.

- Zoning: This document will reveal the future of the area surrounding your property. It will tell you if there are plans to build a highway, industrial zone or other intrusive feature in the neighbourhood that would dramatically reduce the value of your investment and the quality of living for tenants.

- Building documentation: it is crucial to check that the building has a valid building permit and that its actual condition corresponds to the documentation. A common problem is so-called "black buildings" - illegally added balconies, garages or pergolas, which you would be fully responsible for legalizing as the new owner.

- Access to the property: an often overlooked but absolutely crucial point. Is the access road to the house a public road or does it run through private land? If it is private, is there a registered easement for the road? Without legally secured access, your property may be virtually worthless.

Case in point: A road that led nowhere

One of our clients at ARROWS was considering purchasing land for a development project. The seller repeatedly assured him that the driveway "would soon be transferred to the municipality." However, our legal due diligence revealed that the road belonged to two private individuals who had no contractual obligation to transfer it to the municipality, and in addition, there was a pending court case over ownership of part of the road.

The client would have bought a piece of land that he could not legally access. Thanks to the early detection of this risk, we not only negotiated a significant discount on the purchase price for the client, but above all we secured a contractual amendment guaranteeing the establishment of the road easement by a specific date. Legal due diligence is more than just downloading documents. It's about being able to read between the lines and identify risks that are not obvious at first glance. ARROWS lawyers have experience in hundreds of transactions and know exactly what "skeletons in the closet" to watch out for.

The following table summarizes the most important points to check as part of the due diligence process.

|

What to check? |

Where? |

Why is it important? |

|

Property owner |

Land Registry (LV) |

Make sure you are dealing with the real owner. |

|

Liens, foreclosures |

Land Registry (LV, part C) |

The risk of buying a flat with debts that can lead to foreclosure of your new property. |

|

Easements, easements |

Real Estate Cadastre (LV, part C) |

May restrict your use (right of way for a neighbour, lifetime use of the flat for a relative of the seller). |

|

Titles of acquisition |

Collection of deeds in the Land Registry |

Reveals the history of ownership and any disputed transfers in the past. |

|

Consistency of the actual status with the cadastre |

Cadastral map, inspection |

Find out whether the area of the apartment fits and whether there are any unregistered buildings (e.g. balcony, garage). |

|

Access from the public road |

Land registry, zoning plan |

Without secured access, the property may be virtually worthless. |

|

Planning information |

Building Authority |

Protection from future development in the vicinity which would reduce the value of the investment. |

|

Construction and building permit documentation |

Building authority, seller |

Confirmation that the building is legal and safe for use. |

|

Existing lease agreements |

Seller |

You may buy a flat with a tenant who will be very difficult or impossible to evict. |

Contractual minefield: From the booking contract to handing over the keys

The real estate market is no longer just about an agreement between buyer and seller. It has become a field where legal risk is actively traded. While some try to "trap" you into an unfavorable reservation contract to maximize their profit and minimize their liability, others may actively approach you after the purchase with an offer to extract a discount from the seller for hidden defects you didn't even know about. In this environment, quality legal representation is not a luxury, but an absolute necessity. ARROWS is on your side to protect you from both of these threats.

A trap called "Reservation Agreement"

A reservation agreement is not a standardized document and its form can be extremely risky for a buyer. The most common traps include:

- A two-party contract: This is a contract between you and the real estate agent only. The seller is not bound by it and can sell the apartment at any time to another bidder who offers a higher price. You may lose the reservation fee. Always insist on a three-party contract, which also binds the seller.

- Forfeiture of deposit: Beware of wording where the reservation fee is not a deposit on the purchase price, but a non-refundable reward for the real estate agent for "brokering the opportunity". If the sale does not happen in the end, even through the fault of the seller, you will lose your money. Although the courts may declare such arrangements void, this means a lengthy and costly court case for you.

- Mortgage disapproval: what happens if you sign, pay a deposit and the bank subsequently disapproves your loan? Unless the contract contains a break clause for this eventuality, you will most likely lose your deposit.

At ARROWS, we insist that the booking contract is always tripartite and contains clear conditions for the return of the deposit, for example in the event of mortgage disapproval. This protects your money from the outset.

Contact our experts:

The contract of sale and its pitfalls

The contract of sale is the final document, which must be absolutely precise.

- The contract must specify in detail what all is included in the sale - not only the apartment unit, but also the shares in the common parts of the house and land, the cellar, the parking space, or even specific equipment. Any inaccuracy may lead to rejection of the entry in the Land Registry.

- Liability for defects and the "as is" clause. However, such a clause is invalid in most cases. The law gives you, as the buyer, the right to claim for hidden defects for 5 years after you have acquired ownership. A latent defect is one that existed at the time of acceptance but was not detectable on a normal inspection - for example, defective waterproofing under the roof, mould hidden behind plasterboard or problems with the structure of the house.

- At ARROWS, our lawyers make sure that the purchase contract contains a detailed description of the condition of the property and clearly defines the rights and obligations of both parties, including penalties for violating them. We leave nothing to chance.

Money security: safekeeping as a necessity

The cardinal rule is: Never send the purchase price directly to the seller's account before you are registered as owner at the Land Registry. For a secure transaction, use a lawyer, notary or bank escrow. The money is deposited with an independent third party and paid to the seller only when the Land Registry confirms the transfer of ownership to you. This mechanism protects both parties from the risk of fraud. Attorney escrow at ARROWS is a standard part of our service. This ensures that your life savings are completely safe throughout the transaction.

Community of Owners (COO): the invisible partner of your investment

Many investors focus on the apartment itself and forget that they become part of a larger whole - the HOA. That's like investing in a company's stock without looking at its books. You may own a great product (the apartment), but if the company (the HOA) is in debt or mismanaged, your investment is at risk. When you buy an apartment, you become not only the owner of four walls, but also a member of the legal entity and a guarantor of its liabilities. A review of the HOA is therefore just as important as checking the condition of the apartment.

The main risks for an investor in an HOA

- Liability for the debts of the HOA: Each owner is liable for the debts of the community, typically for loans for renovations (facade, roof, elevator), in proportion to the size of their share of the common parts. If the HOA stops making payments, the bank can collect the debt directly from you.

- Non-payers in the house: If the other owners do not pay their contributions to the repair fund and utility advances, the HOA has no money to pay the bills. This can lead to a reduction in services (e.g. the hot water being turned off) or to the other paying owners having to "subsidise" their neighbours' debts from their own resources.

- Transfer of the original owner's debts: This is one of the biggest and least known risks. The common belief that the debts of the original owner do not transfer to the new owner is wrong. Under the law, debts will pass to the new owner if the original owner knew or, with ordinary care, could and should have known about them. In practice, this means that you, as the buyer, have a duty to actively request a certificate of debt-free status from the seller. If you don't do this, you could end up buying tens of thousands worth of debts with the apartment.

How to defend yourself? Due diligence in SVJ

Before signing any contract, it is essential to request key documents from the seller (or, with their written consent, directly from the SVJ):

- SVJ's Articles of Association

- Minutes of the last owners' meetings

- Financial statements for the last years

- Written confirmation that the seller is not indebted to the SVJ

These documents can be used to determine the financial health of the house, planned investments and the amount of contributions to the repair fund. The low state of the fund, together with the planned costly renovation, is a clear warning sign of future high costs. The analysis of the management and bylaws of the HOA is a key part of our ARROWS due diligence. We will uncover for you whether there is a financial time bomb behind the facade of a good-looking house and ensure that you do not buy a "rabbit in the bag".

The tax jungle: How to optimise taxes and avoid penalties

Buying a home is just the beginning. In order to really make a profit on your investment, you also need to master taxes. A mistake on your tax return can cost you tens or even hundreds of thousands of crowns.

Tax on rental income: Lump sum or actual expenses?

Rental income (income minus expenses) is subject to personal income tax at 15% (or 23% on the part of the tax base that exceeds 36 times the average wage). You have two options for claiming expenses:

- Lump sum expenses: the simple way where you deduct 30% of your income as expenses, without any proof. However, the maximum amount of these expenses is limited to CZK 600,000 per year. This option is suitable for investors with low real costs who prefer minimal administration.

- Actual expenditure: a more administratively demanding but almost always significantly more profitable option. You can include in your actual expenses:

- Property depreciation: the largest "paper" expense that dramatically reduces the tax base. A home is depreciated over 30 years (depreciation bracket 5), with 1.4% of the property's purchase price depreciable in the first year and 3.4% in subsequent years.

- Mortgage interest: not the entire payment, but only the portion attributable to interest.

- Costs of repairs and maintenance, property insurance, property tax.

- Lump sum expenditure on transport: Up to CZK 5,000 per month (CZK 60,000 per year) if you can prove that you use the car in connection with the rental.

Our tax advisors at ARROWS will always calculate both options for you. We often find that by claiming actual expenses, especially depreciation, a client can pay almost nothing in tax and save tens of thousands a year.

The following model example shows the difference between the two options.

|

Item |

Option A: Lump sum expenses |

Option B: Actual expenditure (2nd year) |

Note |

|

Annual rental income (15 000 CZK/month) |

CZK 180,000 |

180 000 CZK |

Income is net of rent and utility bills. |

|

Expenses: |

|

|

|

|

Fixed expenses (30 %) |

54 000 CZK |

- |

Simple calculation without documentation. |

|

Depreciation of real estate (price CZK 5 million, 3.4%) |

- |

CZK 170,000 |

Key "paper" expense. |

|

Car lump sum (also used privately) |

- |

48 000 CZK |

4 000 CZK x 12 months. |

|

Total expenditure |

54 000 CZK |

218 000 CZK |

|

|

Tax base (Income - Expenditure) |

126 000 CZK |

-38 000 CZK (Tax loss) |

Actual expenditure may result in a tax loss. |

|

Income tax (15%) |

CZK 18,900 |

0 Kč |

|

|

Annual savings with ARROWS |

- |

18 900 Kč |

The example shows the clear advantage of expert advice. |

Sales tax: How to sell and not pay tax?

The gain from the sale of a property is taxable income unless you meet one of the conditions for exemption:

- Time test: the sale proceeds are exempt if the period between the acquisition and sale of the property exceeds 10 years (for properties acquired from 1 January 2021) or 5 years (for properties acquired before 31 December 2020).

- Residence test: If you have resided in the property for at least 2 years immediately before the sale, the sale proceeds are exempt. It does not have to be a permanent residence registered on the ID card.

- Use for own residential purposes: If you do not meet the time test, but you have lived in the property (even for less than 2 years), you may be exempt if you use the proceeds to provide for another housing need of your own (e.g. purchase of another home, renovation) by the end of the following calendar year. However, you must notify the tax office of this fact.

Beware of VAT! Invisible tax for landlords

Although long-term letting of a flat to a citizen for housing purposes is exempt from VAT by default, there are situations where VAT may apply to you:

- Short-term rentals: Airbnb-type rentals are considered to be accommodation services and are subject to VAT. If your income from this activity exceeds a certain turnover, you become liable for VAT.

- Combination with a business: If you are self-employed and you also rent out an apartment, the rental income is added to your total turnover for the purposes of compulsory VAT registration. You may become liable for VAT quite unexpectedly, even though the rental itself is exempt.

- VAT on new builds: when you buy a flat from a developer, the price is usually increased by VAT (currently 12% for social housing flats up to 120 m2).

Property tax

This is an annual tax paid by the property owner on 1 January of each year. While its amount is not dramatic, it is a regular cost that should be factored into the investment plan.

Conclusion.

A successful investment in a home is not the result of luck, but of careful preparation, reviewing all risks and getting the contracts and taxes right. The road to passive income is paved with hundreds of legal and tax details. Each of these can be either your protection or a trap that will cost you money and a restful night's sleep.

At ARROWS, we specialize in building a bulletproof fortress for you, not a house of cards. Leave chance to others. If you're serious about investing in real estate and want to make sure your money is safe and will appreciate in value, give us a call. Schedule an initial consultation and let's go over your investment plan together. Your peace of mind and profitable investment is worth it.

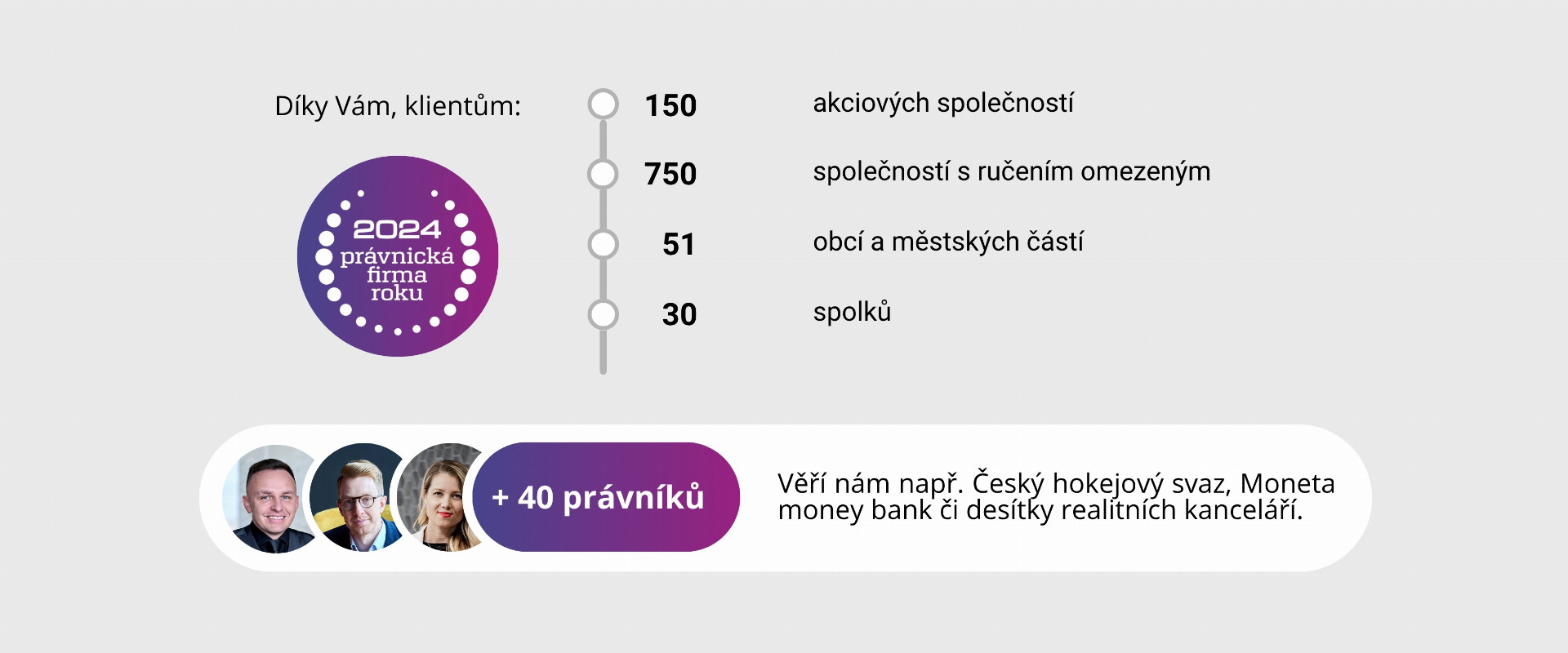

Don't want to deal with this problem yourself? More than 2,000 clients trust us, and we have been named Law Firm of the Year 2024. Take a look HERE at our references.

.png)

.png)