Development studies

- legal and tax aspects

Imagine your game studio on the cusp of success - the game is ready, the players are excited, the spotlight is on you. But the toughest battle is yet to come - not in the fantasy world you've created, but in the reality of paragraphs, contracts and tax obligations. The gaming industry is a huge business today, and success in it is far from being based on a quality game. Many talented studios fall victim to underestimating legal and tax strategy - and sometimes fatally. In this article, we'll walk you through the key legal and tax considerations that no development studio should overlook. Because a quality legal background is not an expense, but an investment in stability and long-term growth.

Author of the article: ARROWS (JUDr. Jakub Dohnal, Ph.D., LL.M., office@arws.cz, +420 245 007 740)

The foundations of your game empire: choosing the right legal form

The first and most important strategic decision you need to make as founders is the choice of the legal form of your business. It is not just a formality, but a cornerstone for future growth, the ability to attract investment and the protection of your personal assets.

Sole proprietorship vs. LLC: Who's with whom in the gaming business?

In the Czech Republic, you primarily have the choice between running your business as a self-employed person (self-employed, trade license) and setting up a limited liability company (s.r.o.). Each form has its advantages and disadvantages, which must be assessed through the lens of your study ambitions.

- Liability: protecting your personal assets As a self-employed person, you are liable for all debts and liabilities of your business with all your personal assets. Imagine if your game inadvertently infringes a third party's copyright or you get into a costly dispute with a publisher. In such a case, you risk not only your company assets, but also your house, car and personal savings. In contrast, an LLC is a separate legal entity. Here, liability is limited only to the amount of the outstanding capital contribution and the company's assets. Your personal assets remain protected.

-

- Self-employed persons: income is taxed at a rate of 15% up to an annual tax base of 36 times the average wage (for 2025 this is CZK 1,676,052) and 23% on the part of the tax base exceeding this threshold. You can claim either actual expenses or expense allowances (typically 40% of income for software development, up to a maximum of

- $800,000). An alternative is the flat tax scheme where you pay one monthly amount including tax and levies, which greatly simplifies administration but has limitations (e.g. annual income up to CZK 2 million and you cannot be a taxpayer

For 2025, the monthly payments under the flat-rate scheme are set as follows:

Band I.

- $8,716 CZK, Band II $16,745 CZK and Band III $27,139

- LLC: The company pays corporate income tax at 21% on its profits (the difference between revenues and expenses). If you wish to take the profits as a shareholder, this share of profits (dividend) is then subject to a 15% withholding tax. This results in so-called double taxation. The advantage of an LLC, however, is the wider possibility of tax optimization, especially if you reinvest the profits back into the company.

- Credibility and growth: how partners and investors see you If you target large publishers, corporate clients or want to attract outside investment, an LLC is practically a must. It feels more professional and credible. For venture capital fund-type investors, entering an LLC (by buying a business stake) is a standard operation, while investing in a sole proprietorship is almost impossible.

- An interesting nuance is that for some smaller partners, on the other hand, the sole proprietorship may be perceived as more trustworthy, precisely because of the unlimited liability, which gives them greater certainty of enforceability of any liabilities.

- Administration and costs Setting up a trade is quick, cheap and administratively easy. Keeping tax records is simpler than double-entry bookkeeping, which is mandatory for LLCs. Setting up an LLC is more complicated and expensive, but as we will show below, it is not an insurmountable obstacle.

- Strategic Insight: Selling Your Business (Exit Strategy) The gaming industry is dynamic and acquisitions of smaller studios by larger players are common. Perhaps selling your company is one of your long-term goals. And here's the crucial difference: selling a business as a going concern is very complicated. In practice, you are selling individual assets (software rights, domain, etc.), not the business itself. In contrast, an LLC is a valuable asset that can be sold as a whole through the transfer of a business interest. It is a clean and standard transaction that investors and buyers prefer. By choosing an LLC, you are therefore setting the stage for future strategic options from the outset.

The real costs of setting up an LLC.

Many aspiring entrepreneurs are concerned about the high cost of setting up an LLC. The reality, however, is much more favorable. If you decide to set up an LLC on your own, the total initial outlay is around £6,000 to £7,000.

- Notarial deed.

- Administrative fee: You will pay a fee of CZK 1 000 for registering your trade at the trade licensing office.

- Registered capital: Long gone are the days when you had to put down $200,000 Today, the minimum share capital is just 1 Kč. Although this figure is public and therefore our ARROWS lawyers usually recommend depositing at least a few thousand crowns to increase credibility, a low minimum capital significantly lowers the barrier to entry.

The choice of legal form is a strategic decision with implications for years to come. At ARROWS, we don't just help you fill out forms. We analyze your business plan, your goals for growth, the potential sale of your company or investor entry, and help you select and set up a structure that will optimally support your growth while effectively protecting your assets.

Crown Jewels: protecting your intellectual property (IP)

The real value of your game studio is not the expensive hardware in your offices. It's the crown jewels in the form of intangible assets: the source code, the graphics, the music, the story, the game mechanics and the brand of your game itself. Losing control of this Intellectual Property (IP) means losing your entire company. Often the biggest risk is not outside, but inside - in unclear relationships with the people who make your game.

Who really owns your game? Employee vs. Freelancer

This is an absolutely crucial distinction to understand.

- Employee (HPP): If a work (code, graphics) is created by your employee as part of their job duties, it is called an employee work. According to Section 58 of the Copyright Act, the property rights in such a work are automatically exercised by you as the employer, unless otherwise agreed. This gives you the right to use, modify and license the work further.

- Extern (on an I.T.O./freelancer): Here the situation is exactly the opposite and poses a hidden threat to many studios. If you hire an external programmer, graphic designer or composer, they remain the author of the work. You, as the client, automatically get nothing more than the right to use the work for the purpose for which it was created (license), unless you explicitly agree otherwise in the contract. You cannot sell the code, use it in another game, or modify it significantly without a properly drafted contract.

There is, however, one important exception: computer programs, databases and cartographic works created on commission are considered to be works of the staff, even if they are created by an outsider. The legal fiction that the client is the employer applies here. But beware, this only applies if the creator is an individual (freelancer). If you hire another company (legal person), this fiction does not apply and everything depends purely on the contract. However, relying on this legal regime without a good contract is always a risk.

An ironclad contract with freelancers (graphic designers, programmers, composers)

Given the above, a good quality contract with any freelancer is an absolute must. The global nature of game development, where your studio in Prague works with an artist from Argentina and a programmer from Poland, multiplies this risk. The legal regulations in their countries may be different. Ambiguity in IP rights is a time bomb that is sure to go off during the first due diligence before an investor comes in or when the company is sold. The discovery that you don't legally own a key piece of code can derail the entire transaction.

The lawyers at ARROWS specialize in this issue and always include key points for your protection in work or license agreements with developers:

- Assignment of copyright ownership: this is the ideal option. The contract provides that the freelancer assigns to you the performance of all property rights in the work. You then become the person who can fully dispose of the work as if you were the original creator.

- Grant of exclusive license: If assignment of rights is not possible, the minimum is to obtain an exclusive license. This ensures that the creator cannot provide the same code, graphics or music to anyone else (e.g. your competitors) and often cannot use it themselves.

- Sublicensing: the contract must explicitly allow you to grant sublicenses to third parties. This is necessary if you will be distributing the game through a publisher who will need their own license.

- The right to edit and complete the work: What if you part ways with the freelancer in bad faith? The contract must guarantee you the right to change, edit and have someone else finish his work without needing his further consent.

- Territorial and temporal scope: the licence must be worldwide ("for the whole universe"), for the entire duration of the property rights (i.e. the life of the author + 70 years) and for all known and future uses.

- NDA (Non-Disclosure Agreement): before any collaboration begins, it is crucial to sign a non-disclosure agreement to protect your ideas, game concepts and trade secrets from leakage.

Your brand, your name: Trademark.

The name of your game and your studio's logo are valuable assets. Without protection, anyone can misuse them, create a confusing copy, or parasite on your reputation. The solution is to register your trademark with the Industrial Property Office (IPO).

- What you get: The exclusive right to use the mark for your products and services (games, software) and to prohibit others from doing so.

- Process: Filing an application with the OHIM, either electronically via the e-portal or in person.

- Cost: The basic administrative fee for filing an application for an individual mark is CZK 5,000 (covering up to 3 classes of products and services).

- Duration: protection is valid for 10 years from the date of filing and can be renewed repeatedly for a further 10 years. The renewal fee is CZK 2 500.

The intellectual property is the DNA of your company. Our lawyers at ARROWS specialize in copyright law in the IT and gaming industry. We prepare contracts that truly protect your "crown jewels", whether you are working with a freelancer from Brno or from Buenos Aires. We'll ensure your trademarks are registered and help you build a fortress around your most valuable assets.

Contact our experts:

Global Rules: Regulation and Compliance

Once you have a solid foundation and protected IP, you are entering the global marketplace. And with it comes a minefield of regulations. Ignoring these rules is not a risk - it's a sure path to problems that can be liquidating for your studio. This is where a sense of urgency becomes key.

50 Million Question: are your loot boxes illegal gambling?

Loot boxes, virtual packages of random content that players can buy with real money, are a key source of revenue for many games. But they are also a huge legal risk. Czech Gambling Act No. 186/2016 Coll. defines gambling using three key features :

- Deposit : The player places a bet (e.g. payment for a loot box).

- Unguaranteed return : It is uncertain whether the stake will be

- Randomness: Winning or losing is determined in whole or in part by chance.

Loot boxes clearly fulfil these characteristics: the player pays real money (the stake) for the chance to win a valuable item (the prize), and the outcome is random. The key point of contention that regulators are focusing on is whether the virtual item in the loot box has real property value - i.e. whether it can be sold or exchanged for real money outside the game, for example on secondary markets.

The problem is the huge legal uncertainty. The Ministry of Finance of the Czech Republic has not yet taken a clear and public position on all types of loot boxes, although it is dealing with this issue. Meanwhile, some EU countries, such as Belgium and the Netherlands, have already labelled loot boxes in certain games as illegal gambling and banned them. Pressure for EU-wide regulation is growing.

For you as a developer, this means only one thing: a huge risk. Operating a gambling game without a licence is one of the most severely punished administrative offences. The penalties are draconian and can completely destroy your studio:

- Fine: Up to $50,000,000.

- Banning and blocking : The Ministry of Finance can put your game on the list of unlicensed Internet games, which will force the Internet provider in the country to block access to it.

- Criminal liability: In extreme cases, unauthorized gambling can be considered a criminal offense, which poses a personal risk to the company's CEO and management.

- Reputational damage: Discovering that your company is operating illegal gambling can irreversibly damage your reputation with players, partners and investors.

This legal uncertainty is also a significant business risk. Imagine dealing with an investor. His lawyers will immediately ask about the risk associated with your monetization model. If your answer is "we don't know, we hope it goes through," it could lead to a reduction in the company's valuation or a complete withdrawal from the investment.

GDPR and PEGI: More than just labels

- GDPR (General Data Protection Regulation): any online game that has players in the EU must comply with the strict rules of GDPR. Your game almost certainly processes personal data, even though you may not realize it. This includes :

- Email address (when registering)

- Username or nickname

- IP address

- Unique device identifiers (Device ID)

- Payment and billing information

- Location data

- Game statistics and behavior associated with a specific account

- You need to have a clearly defined legal basis for this processing (typically the performance of a contract - EULA, or consent for marketing purposes), inform the player what data you are collecting and why (in the Personal Data Processing Policy), and adequately secure the data technically. Breaches of the GDPR can lead to fines of millions of euros.

- PEGI (Pan European Game Information): this age rating system is the standard across Europe. Although it is not legally mandatory in the Czech Republic for purely digitally distributed games, all major distribution platforms (Sony PlayStation, Microsoft Xbox, Nintendo) require its use for inclusion in their stores. The PEGI rating consists of an age category (3, 7, 12, 16, 18) and content descriptors that indicate the presence of, for example, violence, vulgarity, fear or gambling. Getting the right rating is crucial for marketing and market access. For example, a game with a PEGI 18 rating cannot be promoted in media aimed at younger

Your shield and sword: Ironclad EULAs and terms and conditions

The EULA (End-User License Agreement) and Terms and Conditions (T&C) are your key defensive documents. It's the contract between you and each player that defines the rules of the game. Using generic templates downloaded from the internet is a huge risk - they are often incomplete, legally incorrect, or governed by foreign laws that don't apply in the Czech Republic.

Your EULA and GTC must contain at least :

- Grant of License : Clearly specify that you grant the player a limited, non-exclusive, non-transferable license to use the game for personal use only.

- Acknowledgement of IP Ownership : State that all intellectual property rights in the game and its content belong to you.

- Rules of Conduct: Define what is prohibited in the game (cheating, hacking, abusive behavior) and what the penalties are for violation (temporary or permanent ban).

- In-game shopping: Modify conditions for microtransactions, virtual currency and loot

- Limitation of Liability.

- Privacy Policy: link to your GDPR-compliant Privacy Policy.

- Right to Amend: Reserve the right to unilaterally change the terms and conditions with the understanding that you must inform the player of the change.

The regulatory environment is a maze of traps. At ARROWS, we not only help you assess the risk of your game mechanics from a Gambling Act perspective, but also prepare a full set of documents (GDPR, EULA, GTC) that will protect your business and allow you to sleep soundly. We are experienced in communicating with regulators and keep up to date with legislative developments across the EU to ensure your studio is always one step ahead.

Business and Money: contracts, tax and revenue

There's an art to making a great game. Making money from it and keeping it is a craft. This chapter focuses on the practical financial and business aspects that will determine whether your studio is a hobby or a truly profitable enterprise.

Shaking Hands with the Giants: How to Read Distribution Platform Contracts

Your game will reach players through global distribution platforms. Their terms are usually standardized, do not allow for negotiation, and must be accepted as is. It is therefore crucial to understand what you are committing to.

- Steam (Valve): the Steam Direct Distribution Agreement is fairly straightforward. The initial fee for listing a game is $100 (which is refunded once you reach $1,000 in sales). The standard revenue share is 70% for you and 30% for Steam. Steam has strict rules about content that cannot violate copyright, spread hate or abuse children. Adult content is allowed, but must be properly labeled and hidden behind an age gate.

- Apple App Store: the situation is more complicated here. In addition to the main Apple Developer Program License Agreement, you must accept a number of other terms and conditions and adhere to strict App Review Guidelines. Apple requires you to have your own EULA, which must meet their minimum requirements - for example, you must acknowledge that the agreement is between you and the user (not Apple) and that you are fully responsible for maintaining and supporting the app.

- Google Play Store: like Apple, Google has its Developer Distribution Agreement (DDA), which is standardized and non-negotiable. Google places great emphasis on content policies that prohibit, for example, sexual content, violence, hate speech, or deceptive behavior. In addition, Google requires that you grant it a license to modify your APK files to optimize their performance and

Taxing Global Success: How VAT and the One-Stop-Shop (OSS) scheme

If you sell your game or game accessories directly to end customers (B2C) within the European Union, you are entering the world of VAT. The rule is simple, but implementing it can be complex: VAT is levied in the customer's country of residence at the rate applicable in that country. In theory, this would mean you have to register for VAT, file returns and pay tax in each of the 27 EU member states where you have even a single customer.

Fortunately, there is a lifeline in the form of a special one-stop-shop scheme known as One-Stop-Shop (OSS). This system allows you to:

- Register for OSS only in the Czech Republic with the Tax

- File a single quarterly VAT return listing all your sales to end customers across the EU.

- Pay the total VAT in euros to a single account with the Czech Tax

- The tax administration itself will take care of sending the relevant amounts to the individual

The OSS will save you a huge amount of administration and the cost of tax advisers abroad. While there is an annual limit of €10,000 for total EU sales below which you can pay VAT in the Czech Republic, for any commercially successful game this limit is exceeded almost immediately and using OSS is a must.

Maximising your budget: a guide to tax deductible costs

Every penny you legally save in tax is a penny you can reinvest in developing your next game, marketing it, or hiring new talent. For LLCs (and self-employed tax filers), the key to tax optimization is claiming tax deductible expenses - that is, expenses that are demonstrably related to earning, securing and maintaining your income.

For a game studio, typical tax deductible expenses include :

- Hardware and software: Purchase of computers, monitors, graphics tablets, game consoles for testing. Also, software licenses such as game engines (Unreal Engine, Unity), graphics editors (Adobe Creative Cloud), programming tools, etc. Assets with a purchase price of more than CZK 80,000 are reflected in the costs gradually in the form of depreciation.

- Personnel costs: wages and salaries of your employees, including mandatory social and health insurance contributions. This also includes the cost of benefits (e.g. meal vouchers up to the legal limit) or training.

- Travel reimbursements: costs for business trips to international gaming conferences such as GDC in San Francisco, Gamescom in Cologne or the Tokyo Game Show. Airfare, accommodation and meals can be claimed.

- Marketing and Promotion: Expenses for online advertising (Google Ads, Facebook Ads), working with influencers and streamers (their remuneration is a tax deductible expense for you), costs for creating trailers or running a website.

- Operating costs: office rent, energy consumption, internet connection, telephone charges, accounting and legal services.

It is important to remember that some costs are not tax deductible even if you incur them to run your business. Typical examples are entertainment costs such as treats for business partners or gifts (except for small promotional items up to CZK 500 with the company logo).

Whether you're signing a contract with Steam, dealing with VAT for sales in Finland or optimising costs, our legal and tax experts at ARROWS are by your side. We know the specifics of the gaming business and will ensure that your contracts are secure, your EU-wide tax obligations are properly handled and your tax base is legally optimized. Our goal is to ensure that you get the most out of your hard-earned success.

Conclusion. Play smart.

Creating a successful game is only half the battle. The other, often underestimated half, is building a strong and legally protected business that can translate that success into sustainable profit and value. As we have shown, the road from the first line of code to millions of dollars in revenue is paved with legal and tax challenges.

To ignore them is to play Russian roulette with the fate of your studio. The risks are too high:

- Losing intellectual property due to a poorly written freelancer contract.

- Liquidated damages of tens of millions of crowns for game mechanics that the authorities deem to be unlicensed gambling.

- Personal liability for the company's debts if the legal form is wrongly chosen.

- Tax deductions and penalties for incorrectly paid VAT abroad.

Your talent, your vision and your code are too valuable to risk in this way. Don't let legal and tax pitfalls bring your game to a premature end.

The ARROWS team is ready to become your strategic partner. Our experts specialize in gaming law and deal with the exact issues you face every day. We'll help you set a solid foundation, protect your crown jewels and navigate the minefield of regulation safely.

Contact us today to schedule an initial consultation. Let's work together to ensure your story has the best possible ending.

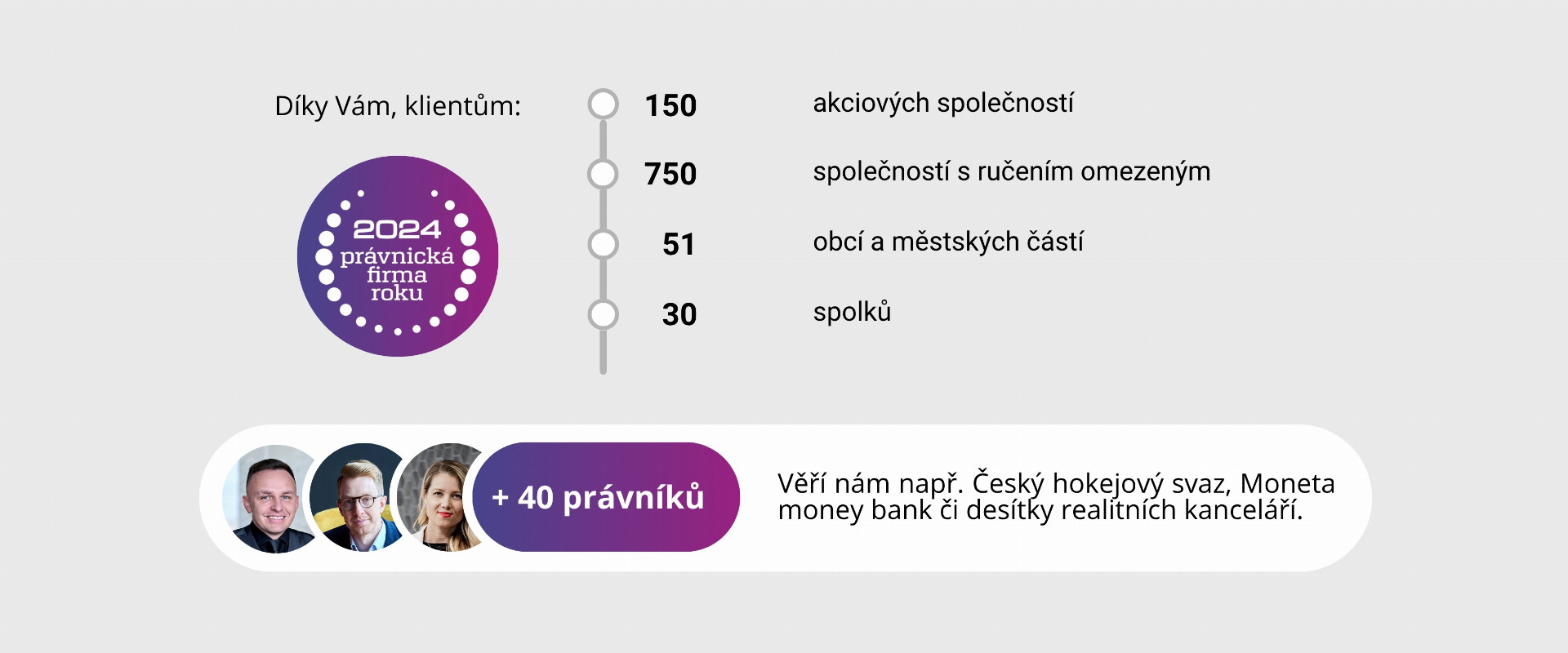

Don't want to deal with this problem yourself? More than 2,000 clients trust us, and we have been named Law Firm of the Year 2024. Take a look HERE at our references.

.jpg)

.png)