When does an heir pay the debts of the deceased

and how can this be avoided?

The death of a loved one is difficult enough on its own. However, it can be even more unpleasant to discover that, along with the deceased's property, their debts are also passed on to their heirs. Many people have no idea how to proceed in such a situation – must the heir pay all the debts, even if they exceed the value of the inheritance? Fortunately, Czech law provides for the protection of heirs in several ways. In this article, we will explain in an understandable way when and how an heir is liable for the debts of the deceased, what accepting an inheritance without reservation vs. with reservation of the estate inventory entails, what reservation of the inventory actually means, and how it protects heirs. We will also describe the institution of convening creditors (convocation) – i.e., a request by the court for creditors to register their claims within three months. You will learn what happens if an heir does not exercise the reservation of inventory or if creditors do not register their claims in time, and what the consequences of hastily accepting an indebted inheritance may be. The article provides an overview of the legal rules with real-life examples and practical advice. The aim is to help you understand these complex rules and show you when it is appropriate to consult a lawyer to avoid serious financial difficulties.

Author of the article: ARROWS (JUDr. Kateřina Müllerová, office@arws.cz, +420 245 007 740)

Does an heir have to pay the debts of the deceased?

The general rule is: Yes. The heir assumes the rights and obligations of the deceased. This means that they inherit not only their property, but also all their debts. The current Civil Code expressly states that the heir is liable for the debts of the deceased in full, i.e. even beyond the value of the inherited property. In other words, if, for example, you inherit property worth $100,000, but the deceased had debts of $150,000, the creditors can claim the entire $150,000—the heir must pay the debts from their own funds if the value of the debts exceeds the value of the property inherited. At this point, it is also important to note that the notary is not required to determine the debts of the deceased, but only all of their property. This means that even after the inheritance proceedings have been discussed and concluded, debts may arise for which you will be liable.

Debts are therefore actually inherited and cannot be automatically avoided. Although the law provides for minor exceptions (e.g., some personal obligations cease to exist upon death), the vast majority of the deceased's financial obligations pass to the heirs. It is therefore essential to determine at the very beginning of the inheritance proceedings what the estate consists of – what assets and debts the deceased left behind. A court-appointed notary can help with this, as they always determine and draw up a list of the deceased's assets and debts (known as an inventory of the estate). This preliminary inventory will give you an idea of whether the debts exceed the assets. If it appears that there are more debts than valuable assets, or that the deceased even had debt enforcement proceedings against them, it is advisable to be vigilant and take steps to protect yourself from an over-indebted inheritance.

Beware of multiple heirs: If there are multiple heirs to the inheritance, each of them is still liable for all of the deceased's debts (it is not the case that each pays only a proportionate share according to their share – the creditor may demand full payment from any of the heirs). Creditors even have the right to choose whether to recover the entire debt from all heirs jointly or from just one of them. The heirs can then settle among themselves, but they are jointly and severally liable to the creditor. This situation can be very disadvantageous for an individual heir – one heir may end up paying everything and then having to go through the complicated process of recovering their share from the others. Fortunately, there are legal options for mitigating or completely avoiding the liability of heirs for debts.

Renunciation of inheritance vs. reservation of inventory: how to defend yourself against debts?

If you are concerned that the estate is over-indebted (debts exceed assets), do not be afraid to take action. The law gives you two main options to avoid having to pay the deceased's debts beyond the scope of the inherited property:

- Renunciation of inheritance: The first and most radical option is to not accept the inheritance at all. An heir may renounce the inheritance by making an explicit declaration before a notary public acting as a court commissioner. By renouncing the inheritance, you waive your entire share of the estate—you will not receive any assets, but you will also not be liable for any debts of the deceased. This is a simple and sure way to avoid problems with debts. Please note: You must refuse within one month of the date on which the court/notary informed you of this right (if you live abroad, you have three months to do so). Once you have refused, your decision is irrevocable – you cannot change your mind later. It is also not possible to reject only part of the inheritance; you must either reject the entire inheritance or nothing at all.

- Acceptance of inheritance with reservation of inventory: The second option, if you do not want to miss out on the inheritance (e.g. due to valuable property), is to accept the inheritance but apply the so-called reservation of inventory. In layman's terms, you request that all of the deceased's assets be listed and take advantage of the rule that you then only pay debts up to the value of the inheritance. You do not reject the inheritance, but you limit your liability in a legal manner. You will continue to pay off the debts, but only up to the amount you inherited – no more. If the debts exceed the assets, it does not matter – as an heir with the benefit of inventory, you will not end up in debt. A situation may arise where all the inherited assets are used to pay off the debts (you will be left with nothing), but you will not have to pay any more from your own pocket (you will not be left in debt). In legal terminology, this used to be called beneficium inventarii (benefit of inventory). It is important that you exercise your right to accept the estate with reservations in a timely manner – as with refusal, the deadline is one month from notification by the court (this can be extended to three months for serious reasons or if you are abroad). You can make a declaration of reservation in writing or orally in a notarial deed. If you miss this deadline or expressly declare that you will not exercise the reservation, it cannot be revoked later. If there are high debts in the estate, we recommend always combining the reservation with a convocation of creditors! This is extremely important.

Tip: If you are unsure of the financial situation of the deceased, it is always safer to exercise the reservation of the inventory.

In practice, the notary must inform you of both options (rejection or reservation of the inventory) at the beginning of the inheritance proceedings. However, the notary is not your personal legal advisor—they only inform you of your rights. The decision is yours. Therefore, carefully consider whether to accept the inheritance and, if so, whether with or without limited liability. The deadlines are short and your choice is final. Neither the rejection nor the application of the inventory can be withdrawn, nor can the declaration that you are not applying for an inventory be revoked.

What exactly is a reservation of the inventory of the estate and how does it protect the heirs?

Reservation of the inventory of the estate means that, at the request of the heir, a detailed inventory of the deceased's assets and liabilities is drawn up, thereby limiting the heir's liabilities. This institution is enshrined in the Civil Code and its purpose is to protect heirs from unexpected debts. If the heir exercises the reservation of inventory properly and in a timely manner, they are only liable for the debts of the deceased up to the value of the inherited property. In practice, this works as follows: a notary (court commissioner) has all the assets and known liabilities of the estate appraised and recorded. This determines the net value of the inheritance, and any debts are paid from this property. The heir is not liable to creditors for anything other than what they have inherited. If the debts exceed the assets, they are paid proportionally (each creditor receives a portion) or the estate is liquidated – see below. An heir with a reservation of inventory will then not pay the difference from their own pocket. However, it is important to be sure that there are no unknown debts that have not been paid in the same proportion as the other debts already reported.

It is important to know that a reservation of inventory only protects the heir who has exercised it. If there are several heirs and at least one files a reservation of inventory, he will pay the debts to a limited extent (only up to the amount of his share of the inheritance), but the other heirs who have not exercised the reservation are liable for the debts without limitation – in full, i.e. even in excess of the value of the inheritance acquired. Therefore, the heirs should agree among themselves and, ideally, all exercise the reservation of the inventory if there is a risk of the estate being in debt. If, for example, one of the five heirs does not exercise it, the creditor can theoretically demand the entire debt from that one heir, who can then claim proportional contributions from the remaining four (who did exercise the reservation). This situation is complicated, so it is best to avoid anyone omitting the reservation.

Exercising the reservation of the inventory also has its limits. It only protects against debts that have been identified and discussed in the inheritance proceedings. It may happen that after the inheritance proceedings have been completed, another debt of the deceased comes to light that no one knew about (typically a forgotten loan, guarantee, etc.). Even an heir who had a reservation is then liable for such a newly discovered debt. They are even obliged to satisfy this creditor at least to the extent that their claim would have been satisfied in the liquidation of the estate. This may mean that the heir will have to pay part of the debt from their own assets if they have already used all the inherited assets to pay other debts. The "brake" in the form of an inventory does not apply if the debt emerges later. However, there is a solution to protect against unexpected debts discovered later—the solution is to convene the creditors by the court, known as a creditors' meeting.

Convening creditors (convocation) – notice to creditors to register their claims

Another useful tool to protect yourself against hidden debts is the so-called convocation of creditors, i.e. convening creditors through the court. This procedure is regulated by the Civil Code (Sections 1711–1712) and is carried out only at the request of the heir (or estate administrator) before the inheritance proceedings are concluded. The condition is that the heir has exercised the right to an inventory – without this, it is not possible to propose a convocation of creditors. If you are concerned that there are any unknown debts (e.g., the deceased may have had debts that you are unaware of), propose to the court that creditors be summoned. The notary (court commissioner) will then issue a resolution, which is a public notice posted on the court's official notice board for at least 30 days. The notice is also delivered directly to known creditors. In the notice, the court sets a deadline (at least 3 months) during which creditors can register their claims and provide evidence of them. This officially determines what debts are encumbering the estate so that they can be taken into account.

The convocation of creditors serves to protect the heir. Thanks to this, it should not happen that after the inheritance is settled, a "free rider" – a forgotten creditor – pops up and wants to be paid. Or rather, they will be able to defend themselves by saying that they made the convocation. The heir is not obliged to satisfy creditors who did not register in time during the convocation. Specifically, the law stipulates that a creditor who does not come forward within the specified period is not entitled to payment of the debt from the heir if the estate has been exhausted to satisfy the claims of creditors who came forward in time during the convocation. In practical terms, this means that creditors who register will be satisfied (either in full or proportionally, according to the value of the estate), and if someone who did not register within the convocation period comes forward later, they are out of luck – they will receive nothing if there is nothing left of the estate.

Those who do not register will not be able to claim payment of debts at a later date. Any assets remaining after all debts have been paid will be yours without any further risk. In other words, thanks to the convocation of creditors, you will know where you stand – all claims will be revealed, and those that remain hidden cannot be recovered from the heir after the deadline has expired, provided that the property has been used to pay the claims that have been registered.

Exceptions: It is good to know that convening creditors does not protect you completely from all situations. For example, it does not apply to secured creditors (those who have, for example, a lien on the deceased's property – they will be satisfied from the sale of the collateral, even if they did not register). Also, if the heir knew about a debt, they cannot then claim that the creditor was not registered – a creditor of whom the heir had demonstrable knowledge may still enforce the debt. However, in the vast majority of normal cases, the convocation will provide the necessary peace of mind. After the proceedings have ended, the heir does not have to pay unregistered creditors and can take possession of the net inheritance with peace of mind.

What if you do not request an inventory (do not exercise the reservation)?

The decision to have the inheritance confirmed without reservation should be carefully considered. As described above, if the heir does not exercise the reservation, they are liable for the debts of the deceased without limitation – in full. Only consider this if you are absolutely certain that there are no significant debts. Typically, this would be the case if, for example, it was your grandparents whose assets and liabilities you are fully aware of (and who did not have any loans, for example). In all other cases, the following applies: certainty is certainty – it is better to apply for an inventory. Some people are afraid of this administrative procedure, but the notary is there to ensure that the inventory is carried out and it does not cost you any additional fees. If you do not make an inventory and a debt later comes to light, it will be too late to chase it.

What exactly is the risk if additional debt emerges and you did not make a reservation in the inventory? The creditor can demand repayment from you in full, even if this means seizing your personal property. In addition, you will lose the option of using the convocation – this is not done without reservation, so the creditor can easily come a year after the end of the inheritance and still collect the money from you with interest. This is a big difference from a situation where you have used the reservation and convocation – in that case, the late creditor would not be able to get their money.

Summary: Failure to use the reservation of inventory and convocation may expose you to the risk of paying the deceased's debts for the rest of your life. Only do so if you are absolutely certain that there is no such risk.

What if creditors do not come forward in time?

The ideal situation for heirs is when, after the convocation (summoning of creditors), all relevant creditors register their claims within the deadline – you can then be sure that you will settle with all of them at once as part of the estate. However, sometimes one of the creditors misses the deadline (perhaps they overlooked the debt, did not respond in time, or did not know about the death). What does this mean for you? If the estate's assets have been fully exhausted to pay the registered creditors, the late creditor has no claim against you. In practice, such a creditor would be left empty-handed – the heir could argue that they should have registered their claim in the convocation and, since they did not do so, they are out of luck. This applies provided that the heir acted prudently – they exercised their right to make a reservation and proposed that the creditors be convened.

However, there is one if: If, after the registered debts have been paid, there is still some value left in the estate (some property), then, in theory, the late creditor could claim satisfaction at least from this remainder. Therefore, in practice, indebted estates are often settled by using all the assets to pay off the debts or by liquidating the estate (the court orders that all assets be used to pay off the debts and that nothing remains for the heirs). In this case, delayed creditors have nothing to claim. For an honest heir who has nothing to hide and cooperates with the notary, convocation is therefore an effective protection.

Conversely, if the heir did not make use of the reservation of inventory and convocation, then no protection period exists – any creditor may assert their claim at any time, the limitation periods run as standard, and the heir who accepted the indebted inheritance without restriction is liable for all debts without limitation in time or scope.

Practical examples: when an heir accepts an indebted inheritance without careful consideration

Let us illustrate what can happen when an heir underestimates the situation and accepts an inheritance with debts without using the available defenses. For example, Mr. Karel inherited a family house after the sudden death of his uncle. In the euphoria of acquiring valuable real estate, he signed at the notary's office that he accepted the inheritance and did not expressly exercise the right to inventory. However, he soon discovered that his uncle had an outstanding loan, a signed promissory note, and credit card debt. The total amount exceeded the value of the house. Because Mr. Karel did not request an inventory, he had to pay the debts in full—he obtained part of the money by selling the house and paid the rest out of his own pocket. If he had exercised his right to an inventory with convocation, he would have only paid up to the value of the house and no more. Thus, due to his lack of knowledge, he found himself in personal financial difficulties.

Premature acceptance of an indebted inheritance can have long-term and serious consequences. The heir may find themselves without assets, with debts, or even insolvent. Younger or vulnerable heirs (those who have just come of age, seniors) in particular may end up with a debt burden that will make their start in life much more difficult.

Conclusion: what to look out for and when to seek legal assistance

The key advice is: always assess the risk of debt before accepting an inheritance. Do not succumb to pressure to quickly sign that you are accepting the inheritance without knowing what it entails. Find out as much information as possible – a notary will provide you with an overview of known assets and liabilities. If you suspect that the deceased may have been in debt, consider refusing the inheritance or at least accepting it with the right to make a reservation. It is better to exercise this right as a precaution if you are unsure about the deceased's financial situation. Refuse the inheritance if it is clear that the debts significantly exceed the assets and you have no emotional attachment to them – this will save you a lot of trouble.

Do not hesitate to request a meeting with the creditors if the estate is complex and there may be hidden debts. This will prevent someone from coming up with a debt you had no idea about a few years after the inheritance has been settled. Remember that all these requests (rejection, reservation, convocation) must be made within the statutory deadlines, otherwise you will lose them.

When to seek legal assistance? Ideally, before you make an irreversible decision in the inheritance proceedings. If you are unsure what is best for you, consult a lawyer. An experienced lawyer will help you analyze the state of the estate, explain the implications of each step, and suggest the best solution (e.g., agreement with creditors, liquidation of the estate by the court, etc.). Consultation is particularly worthwhile in cases where there is significant debt, multiple heirs with differing opinions, or where minor heirs are at risk of inheriting debts.

FINAL TIP: Don't be afraid to ask the notary questions during the inheritance proceedings and actively address your concerns. You have the right to be cautious. Inheritance often involves an emotional burden, but from a legal perspective, it is primarily a responsibility for property and debts. Approach it with knowledge. This will build trust not only with any co-heirs and creditors, but also with yourself that you can handle the situation. And if you don't know what to do, professionals are there to help you take the right steps. Consulting a lawyer early on can prevent many unpleasant situations and ensure that you don't have to pay extra for the painful loss of a loved one.

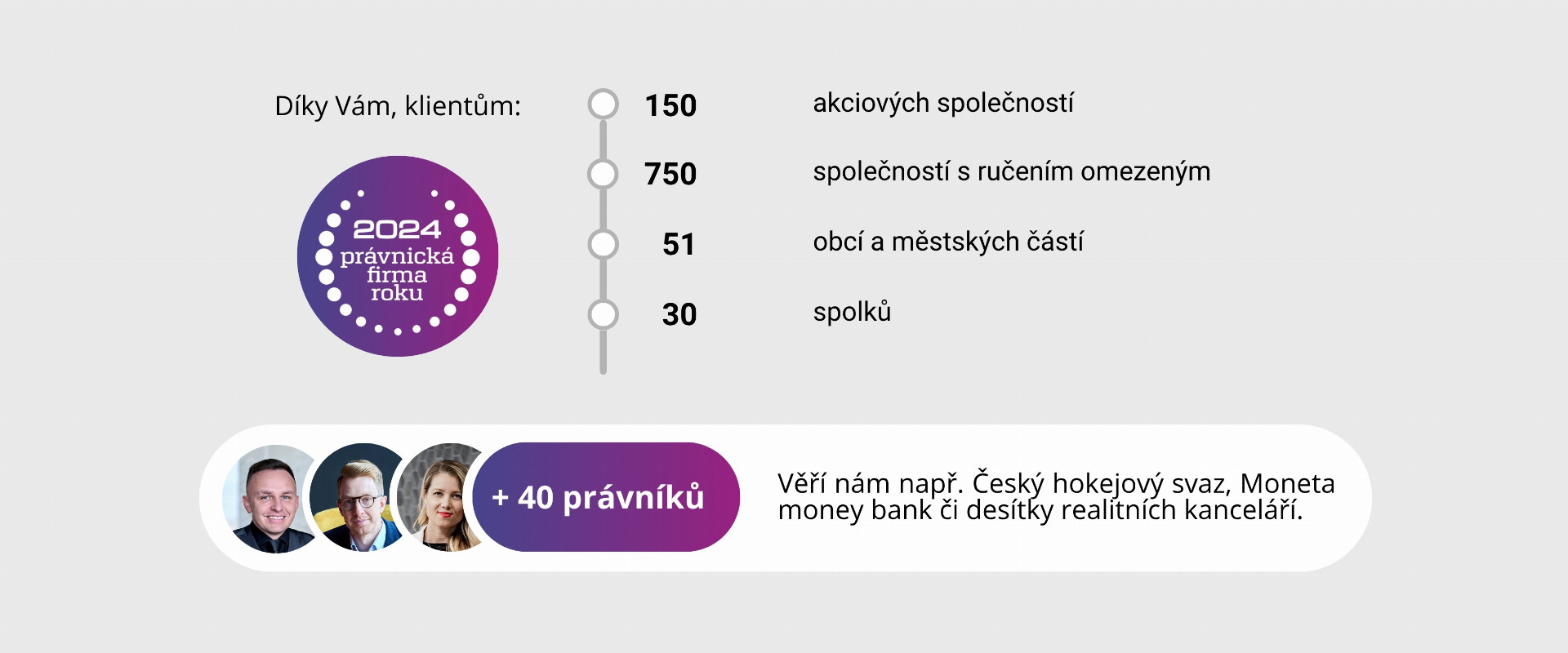

Don't want to deal with this problem yourself? More than 2,000 clients trust us, and we have been named Law Firm of the Year 2024. Take a look HERE at our references.

.png)